LenderHomePage has been a strategic partner to Mountain West Financial since 2010. We have leveraged LHP’s robust enterprise platform and Compliance Engine to manage our multi-branch and 100’s of Loan Officer pages. The “MW Mortgages” mobile app, our enterprise-edition smart phone app has also been developed by LHP which has provided our brand a seamless user experience across all touchpoints.

Executive Vice President at Mountain West Financial, Inc.

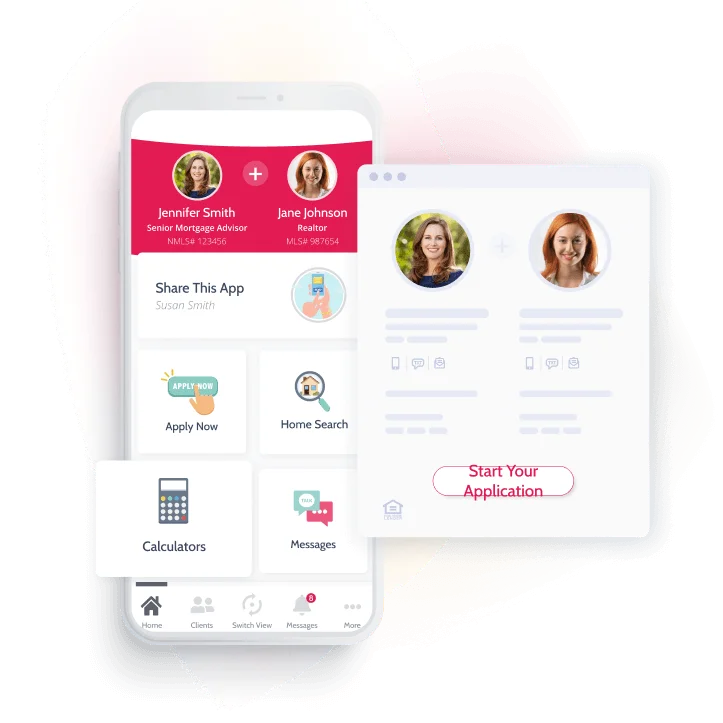

Co-Branded Realtor Apps

Realtors are key allies in your business success, so why not provide them with a tool that helps your partners delight their homebuyers? Our interactive mobile app empowers Realtors with a powerful resource that helps buyers navigate the home buying process, creating long-term relationships underpinned by trust. It's a win-win with long-term benefits for everyone!

More Completed 1003s

The intuitive, easy-to-use, chat-style interface of our 1003 makes the application process less intimidating, resulting in more completed apps.

Customize it to match your company's brand. The front-end automation frees up your Loan Officers’ time so they can focus on critical tasks like building relationships with Borrowers, nurturing leads, and quickly funding loans.

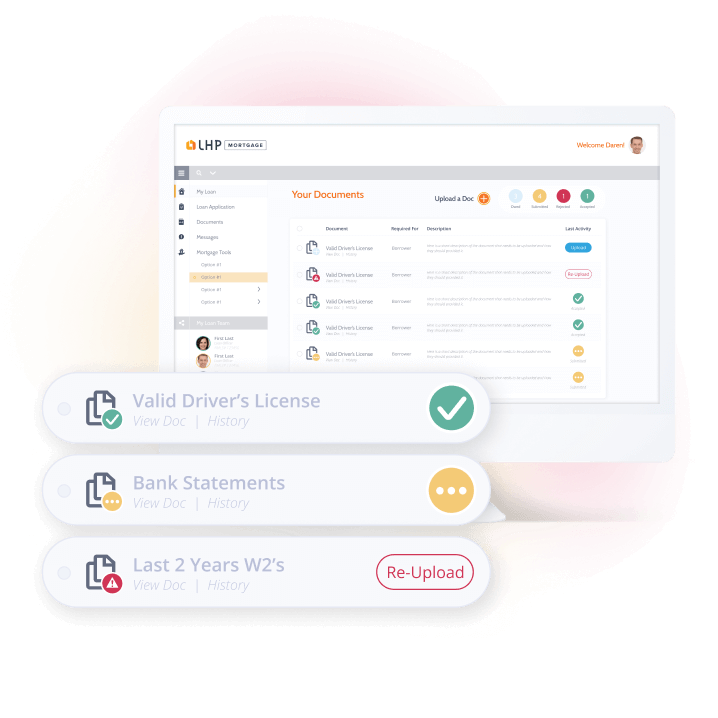

Loan Status Updates

Loanzify’s intuitive Milestone Tracker guides Borrowers through the application process in a pressure-free manner, while transparency gives the entire loan team insight for managing the loan efficiently.

Expand or collapse the predefined timeline to fit your needs & requirements while automated notifications keep the loan moving quickly, saving time and resources.

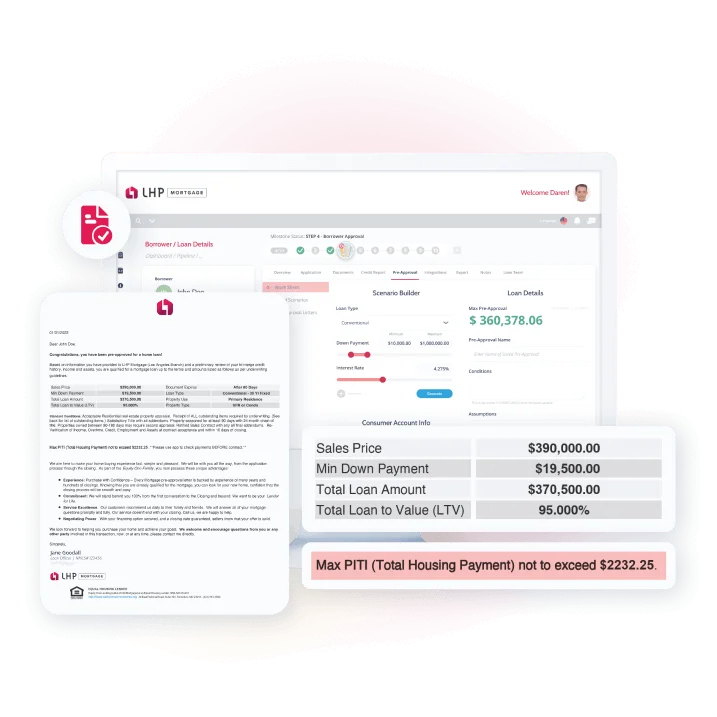

Automated Pre-Approvals

Impress and empower your Borrowers with on-demand pre-approval letters.

Customize and brand the dynamic "Pre-Qual Calculator" and automated "Pre-Approval Letters" features. Then preset a max pre-approval amount for each file, and watch the pre-approval letters roll in with set-it-and-forget-it ease!

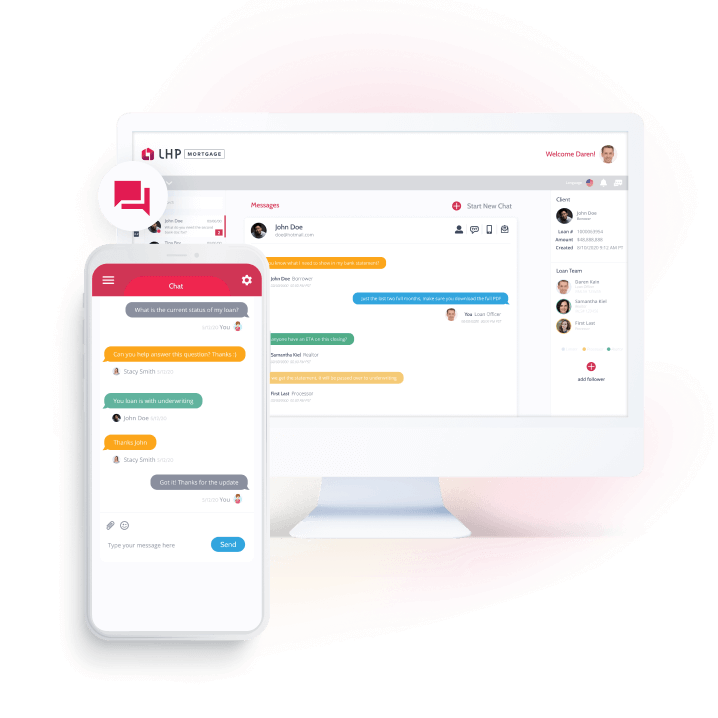

Messaging and Communication

Team/Borrower collaboration is a snap with Loanzify CX.

Automated borrower SMS, push notifications, autoresponders, templated email notices, and in-app instant messaging help you stay connected with your Borrowers while customizable checklists, shareable notes, and group chat keep the team plugged in, ensuring everyone has access to the information they need for optimum efficiency.

Mortgage Calculators

Help your Borrowers unlock the mysteries of mortgage costs with our interactive calculators. An inviting and easy-to-use tool, they'll be able to quickly get accurate calculations for any loan type—including monthly payments, APRs, amortization information, plus more! You can also use it to explore multiple scenarios in seconds to help your Borrower feel confident in their decision.